Saudi Arabia Signs OECD Multilateral Instrument - Impact On Tax Treaties and Key Takeaways for Foreign Investors into Saudi Arabia

Oecd/G20 Base Erosion and Profit Shifting Project Developing a Multilateral Instrument to Modify Bilateral Tax Treaties: Organisation For Economic Co-Operation And Development, Oecd: 9789264219243: Amazon.com: Books

What is Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting? - Taxbeech

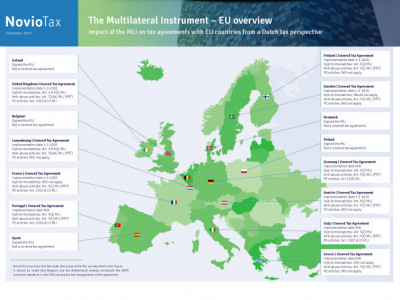

The Multilateral Instrument: The impact on Wealth & Asset Management - Financial Services Thought Gallery

OECD: Multilateral Convention to implement Tax Treaty related measures to prevent BEPS | Global Business Coalition

About The extent to which the Multilateral Instrument (MLI) modifies an existing tax agreement depends on the MLI Positions of the Contracting Jurisdictions. - ppt download

Should Developing Countries Sign the OECD Multilateral Instrument to Address Treaty-Related Base Erosion and Profit Shifting Measures? | Center for Global Development | Ideas to Action